![]()

An Information Guide About Nigerian Naira. A comprehensive guide.

History of the Nigerian Naira

The Nigerian Naira, denoted as “₦” and issued by the Central Bank of Nigeria (CBN), is the official currency of Nigeria. Since its introduction, the Naira has undergone various transformations reflecting Nigeria’s economic and political evolution.

Introduction of the Naira in 1973

The Naira was introduced on January 1, 1973, replacing the Nigerian pound, which had been in use since Nigeria gained independence in 1960. This move was part of Nigeria’s push to align with decimal currency systems, as the Naira replaced the pound at a rate of £1 to ₦2. It made Nigeria the last British colony to abandon the pound for a decimal currency.

Definition Of Nigerian Naira

The Nigerian Naira (NGN) is the official currency of Nigeria, issued by the Central Bank of Nigeria (CBN). It was introduced in 1973, replacing the Nigerian pound at a rate of 1 Naira for 2 shillings. The currency is subdivided into 100 kobo.

The Naira is represented by the symbol “₦” and is notable for being used in a country that is Africa’s largest economy and most populous nation. The Naira’s value is influenced by various factors, including oil prices (as Nigeria is a major oil exporter), government policies, and broader economic conditions both domestically and internationally .

Over the years, the Naira has experienced significant fluctuations in its value due to various economic challenges, including inflation and exchange rate volatility. The currency is used in everyday transactions across Nigeria, and its denominations include both coins (in kobo) and banknotes in various values ranging from ₦5 to ₦1,000 .

Evolution of Banknotes and Coinage

The initial series of banknotes in 1973 featured denominations of 50 kobo and ₦1, with ₦5, ₦10, ₦20, and ₦50 denominations introduced gradually over the years to accommodate economic changes. The introduction of higher-denomination notes, such as ₦100, ₦200, ₦500, and ₦1,000, in subsequent decades was largely a response to inflation and the need for higher-value transactions.

The Impact of Economic Changes on the Nigerian Naira

Nigeria’s oil-dependent economy has heavily influenced the Naira’s value. During the oil boom of the 1970s, the Naira was strong, but the downturn in oil prices in the 1980s and beyond led to significant devaluation. The Structural Adjustment Program (SAP) of 1986, aimed at reforming Nigeria’s economy, introduced a floating exchange rate for the Naira, resulting in further devaluation.

Recent Reforms and Redesign Of Nigerian Naira

To curb inflation and counterfeiting, the Central Bank has periodically redesigned the Naira. The most recent series of reforms, including currency redenominations and digital currency initiatives, aim to stabilize the Naira and improve its security features.

For more details on the evolution of the Nigerian Naira, visit the Central Bank of Nigeria’s website and other reputable financial sources. These historical changes reflect Nigeria’s journey through economic shifts and the government’s efforts to ensure the currency meets modern demands.

Exchange Rates of the Nigerian Naira

The exchange rate of the Nigerian Naira (₦) is a critical indicator of Nigeria’s economic health and stability. Due to various economic pressures and global market influences, the value of the Naira against foreign currencies has undergone significant fluctuations over the years. Here’s an in-depth guide to understanding the exchange rate dynamics of the Nigerian Naira.

Overview of the Nigerian Naira Exchange Rate System

Nigeria operates a multi-tiered exchange rate system, which includes an official rate managed by the Central Bank of Nigeria (CBN) and a parallel market rate driven by supply and demand. The official rate is regulated by the CBN through foreign exchange policies, while the parallel market rate reflects the real-time demand for foreign currencies, primarily U.S. dollars.

Historical Fluctuations in the Naira’s Value

The Naira was initially introduced in 1973, replacing the Nigerian pound. For the first decade, it maintained a strong rate against the U.S. dollar due to high oil prices, as Nigeria is a major oil exporter. However, the 1980s brought an economic downturn and a need to devalue the Naira under the Structural Adjustment Program (SAP) in 1986. Since then, inflation, devaluation, and economic challenges have impacted the Naira’s value, leading to both managed and free-floating periods.

Factors Affecting the Naira’s Exchange Rate

- Oil Price Volatility: Nigeria’s heavy dependence on oil exports means that fluctuations in global oil prices can greatly impact the Naira’s value. A decline in oil prices often leads to a weaker Naira.

- Foreign Exchange Reserves: The CBN’s ability to maintain foreign exchange reserves impacts its ability to stabilize the Naira. Higher reserves help support the Naira’s value.

- Inflation Rates: Persistent inflation reduces the purchasing power of the Naira, making it less valuable compared to stable foreign currencies.

- Demand for Imports: High demand for foreign goods increases the demand for foreign currencies, putting pressure on the Naira.

Dual Exchange Rate System: Official vs. Parallel Market Rates

Nigeria’s dual exchange rate system consists of an official rate, managed by the CBN, and an unofficial or parallel market rate, determined by demand and supply in the open market. Due to forex shortages, the parallel market often quotes a much higher exchange rate than the official rate. This gap affects the costs of imported goods, remittances, and investment inflows.

Recent Policies and Initiatives for Exchange Rate Stabilization On Nigerian Naira

In recent years, the Central Bank of Nigeria has taken steps to reduce the disparity between official and parallel market rates. Some of these include:

Foreign Exchange Restrictions: Limiting access to foreign exchange for importing certain goods to curb forex demand.

“Naira for Dollar” Policy: Incentivizing remittances by offering extra Naira for every dollar sent through official remittance channels.

Rate Unification Efforts: Attempting to bring the official and parallel rates closer together to reduce market volatility.

Current Trends and Future Outlook of Nigerian Naira

The exchange rate of the Naira remains subject to both domestic and global economic conditions. In the near future, stability efforts will likely focus on managing inflation, increasing foreign exchange reserves, and fostering a balance between supply and demand for foreign currencies.

For accurate and up-to-date exchange rates, you may refer to official financial platforms and the Central Bank of Nigeria’s website. The Naira’s exchange rate remains a critical focus area for economic policymakers in Nigeria.

Nigeria Denominations: A Guide to Naira Banknotes and Coins

The currency denominations in Nigeria consist of banknotes and coins issued by the Central Bank of Nigeria (CBN). Each denomination is designed to reflect Nigeria’s culture, history, and economy. Here’s a look at the Naira denominations and the unique features they hold.

Overview of the Nigerian Naira

The Naira (₦) is the official currency of Nigeria and is divided into smaller units called kobo, where 100 kobo equals 1 Naira. Since its introduction in 1973, the Naira has seen several redesigns and new issues in response to the evolving needs of the economy and security requirements.

Banknote Denominations of the Nigerian Naira

The Nigerian Naira banknotes come in various denominations designed for different transaction needs. The available notes are as follows:

- ₦5 – The lowest denomination banknote, with imagery reflecting Nigeria’s agricultural sector.

- ₦10 – Often used for smaller transactions, highlighting Nigerian agriculture and rural life.

- ₦20 – Introduced to commemorate Nigerian leaders, featuring notable historical figures.

- ₦50 – Popular for everyday transactions, showcasing Nigeria’s cultural diversity.

- ₦100 – A higher-value note used frequently in mid-value transactions.

- ₦200 – Featuring notable figures, this denomination aids in transactions where larger values are required.

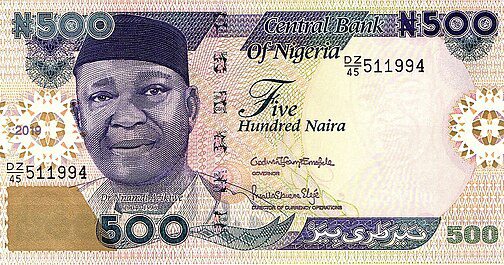

- ₦500 – One of the higher denominations, often used in larger transactions.

- ₦1,000 – The highest denomination in Nigeria, primarily used for high-value transactions.

Each note is designed with distinct colors, security features, and images of significant Nigerian personalities and cultural elements to prevent counterfeiting and promote national pride.

Coin Denominations of the Nigerian Naira

The coin denominations in Nigeria, while less commonly used than banknotes, serve an important role in smaller transactions. The Nigerian coins include:

- ₦1 and ₦2 coins – These are used for low-value purchases and transactions, though their usage has declined in recent years due to inflation.

- 50 Kobo – The lowest denomination coin, which is now rarely seen due to reduced purchasing power.

Coins in Nigeria are generally made from durable metals and bear symbols reflecting Nigerian culture, wildlife, and heritage.

Redesign and Security Features

The Central Bank of Nigeria periodically redesigns the Naira to prevent counterfeiting and enhance security. Some security features include watermarks, raised printing, security threads, and color-shifting inks on higher denominations, especially on the ₦500 and ₦1,000 notes. These features help ensure that the currency remains secure and trusted by the population.

Recent Changes and New Issues

In recent years, the CBN has introduced various initiatives to modernize the currency system, including the digital eNaira as a form of digital currency. There have also been talks of phasing out lower-value notes in favor of higher denominations or electronic transactions to reduce cash handling costs.

Future of Nigerian Denominations

The future of Nigerian denominations may see further shifts towards digital transactions, with lower denominations being phased out due to inflation and currency management costs. However, physical denominations will remain essential for the unbanked population and in areas with limited access to digital finance.

Nigerian Currency Symbol: The Naira Sign (₦)

The Nigerian currency symbol, denoted as “₦,” is a widely recognized sign representing the Nigerian Naira. Introduced in 1973, this symbol is an essential part of Nigeria’s identity in global finance and trade. Here is a comprehensive guide to understanding the Naira symbol, its history, uses, and significance.

History of the Nigerian Currency Symbol

The Naira symbol (₦) was introduced alongside the Nigerian Naira in 1973 when Nigeria transitioned from the British pound to a decimal currency system. The Central Bank of Nigeria (CBN) created the symbol to represent the Naira in the same way the dollar sign ($) represents the U.S. dollar, promoting a distinct identity for the Nigerian currency on a global scale.

Design and Meaning of the ₦ Symbol

The Naira symbol, ₦, consists of a capital letter “N” crossed by two horizontal lines. This design bears similarities to other currency symbols, such as the dollar sign ($) and the euro sign (€), where horizontal lines represent the stability and universality of currency. The choice of “N” refers to “Naira,” with the lines symbolizing its official status and value within Nigeria.

How the Naira Symbol is Used

The Naira symbol is used before the numeric value to indicate amounts in Nigerian currency. For example:

₦500 signifies 500 Naira

₦1,000 signifies 1,000 Naira

In Nigeria, the symbol is commonly used in both formal and informal contexts, from official documents and price tags to restaurant menus and digital transactions. The symbol is also recognized and used in currency exchanges and international transactions involving the Nigerian Naira.

Availability of the Naira Symbol on Keyboards and Digital Platforms

While the Naira symbol is not standard on most international keyboards, it can be inserted digitally using certain key combinations or by selecting it from character maps on computers and mobile devices. For Windows, users can typically access it using the “Character Map” application, and for macOS, it may be found through “Emoji & Symbols.” Additionally, certain platforms, like Google Docs, allow users to insert the Naira symbol by selecting it from special character options.

The Importance of the Naira Symbol in Nigerian Economy and Culture

The Naira symbol represents more than just currency; it reflects Nigeria’s independence, economic identity, and cultural pride. Since its inception, it has symbolized Nigeria’s sovereignty and its aspirations for economic growth and development. Over the years, it has become an emblem of the country’s monetary system and is often referenced in discussions about Nigeria’s economy and policies.

Future of the Naira Symbol in Digital Transactions

With the introduction of Nigeria’s digital currency, the eNaira, the Naira symbol is likely to become even more integral in digital finance. The CBN’s push towards digital transactions could lead to more widespread digital representation of the Naira symbol, both locally and globally, ensuring its relevance in a tech-driven financial ecosystem.

The Naira symbol, ₦, is a vital component of Nigeria’s financial landscape and national identity, embodying the value of the Nigerian Naira in both tangible and digital transactions.

Nigerian Economy Overview

Nigeria, Africa’s most populous nation, has one of the continent’s largest and most diverse economies. Known for its vast natural resources, especially crude oil, Nigeria has faced both opportunities and challenges in building a balanced economy. Here’s a comprehensive look at the structure, key sectors, and challenges in the Nigerian economy.

Historical Background

Early Economic Development

Nigeria’s economy before independence in 1960 was largely agrarian, with agriculture serving as the backbone of the economy and the main source of foreign exchange. Cocoa, groundnuts, rubber, and palm oil were significant exports.

Oil Discovery and Boom

The discovery of oil in the Niger Delta in the 1950s, and the subsequent oil boom of the 1970s, transformed Nigeria’s economy. Oil quickly became the main revenue generator, leading to a shift away from agriculture. This rapid change contributed to the nation’s dependency on oil exports.

Structure of the Nigerian Economy

Agriculture

Agriculture remains crucial, employing over 30% of the workforce and contributing to food security and rural development. Crops such as cassava, yams, maize, and rice are widely cultivated. Despite its potential, agriculture’s productivity is limited by poor infrastructure and access to credit.

Oil and Gas

Nigeria is one of the top oil producers in Africa and holds the continent’s largest reserves. Oil contributes significantly to GDP, government revenue, and exports. However, this dependence on oil makes the economy vulnerable to global oil price fluctuations.

Services Sector

The services sector, including banking, telecommunications, and real estate, has seen rapid growth, driven by reforms and investment. The banking sector has especially expanded following regulatory reforms that increased efficiency and stability.

Manufacturing and Industry

Manufacturing accounts for a smaller portion of GDP, mainly producing consumer goods, cement, and processed foods. The sector faces challenges such as high production costs, unreliable electricity, and infrastructure limitations.

Key Economic Indicators

Gross Domestic Product (GDP)

Nigeria’s GDP growth has been erratic, influenced by oil prices, policy changes, and global economic trends. While GDP growth was strong in the early 2000s, recent years have seen slower growth due to falling oil prices and inflation.

Inflation

Inflation has been a persistent issue, driven by factors like currency devaluation, high import costs, and supply chain disruptions. Double-digit inflation affects consumer purchasing power, creating challenges for low- and middle-income families.

Unemployment

Unemployment, especially among youth, is a significant issue, with rates over 30% in recent years. The slow growth in job creation, despite a large working-age population, has led to concerns about poverty and social stability.

Government Economic Policies

Fiscal Policy

Nigeria’s fiscal policy is influenced by oil revenue. High oil prices typically lead to increased government spending, while low prices force budget cuts. To diversify revenue, the government is focused on improving tax collection and reducing overreliance on oil.

Monetary Policy

The Central Bank of Nigeria (CBN) implements monetary policy primarily through interest rate adjustments and exchange rate management. Efforts to stabilize the naira (NGN) have included tightening currency controls and encouraging non-oil exports.

Economic Diversification Plans

Recognizing the risks of oil dependency, Nigeria has launched diversification initiatives such as the Economic Recovery and Growth Plan (ERGP) and the National Development Plan (NDP) to encourage investment in agriculture, manufacturing, and technology.

Major Challenges

Infrastructure Deficit

Nigeria faces a significant infrastructure gap, particularly in energy, transportation, and healthcare. Power supply is often inconsistent, hindering productivity and raising production costs.

Corruption

Corruption affects both public and private sectors, resulting in financial losses, inefficiency, and an unstable investment environment. Efforts to combat corruption include the establishment of agencies like the Economic and Financial Crimes Commission (EFCC).

Dependence on Oil

Despite diversification efforts, oil revenue continues to dominate Nigeria’s economy. This dependency makes the economy vulnerable to external shocks, such as fluctuations in oil prices and global demand.

Opportunities and Future Outlook

Potential for Economic Diversification

Nigeria has considerable potential for growth in sectors like agriculture, mining, and information technology. Increased focus on small and medium-sized enterprises (SMEs) could enhance economic resilience and job creation.

Rising Digital Economy

Nigeria’s technology sector, often called “Silicon Savannah,” is rapidly growing, with Lagos being a hub for fintech and e-commerce startups. This sector is poised to contribute more significantly to GDP, create jobs, and attract foreign investment.

African Continental Free Trade Area (AfCFTA)

As a member of the AfCFTA, Nigeria stands to benefit from increased trade with other African countries, enhancing export opportunities and fostering economic growth.

Naira Devaluation:

The Nigerian naira (NGN) has experienced periodic devaluation over the years, a process influenced by economic policies, oil price fluctuations, and international pressures. This guide covers the fundamentals of naira devaluation, its causes, impacts on the economy, and the government’s responses.

What is Naira Devaluation?

Definition of Currency Devaluation

Currency devaluation is a deliberate downward adjustment of a country’s currency value relative to another currency or basket of currencies. In Nigeria’s case, naira devaluation refers to the decline in the value of the naira, primarily against the U.S. dollar.

Naira Devaluation vs. Depreciation

While devaluation is a policy action taken by the government or central bank to reduce currency value, depreciation occurs naturally due to market forces. Nigeria has experienced both as the naira faces pressure from economic challenges.

Historical Background of Naira Devaluation

Early Years and Initial Devaluation

The naira was relatively strong from its introduction in 1973 until the 1980s, when an economic crisis led to significant devaluation as part of the Structural Adjustment Program (SAP). Since then, the naira has undergone various adjustments.

Recent Devaluations

In recent years, the naira has been devalued multiple times, particularly from 2015 onward. Factors like falling oil prices, high import demand, and reduced foreign reserves have prompted these adjustments, affecting the official and parallel (black market) exchange rates.

Causes of Naira Devaluation

Oil Price Dependency

Nigeria relies heavily on oil exports, with oil accounting for a large share of government revenue and foreign exchange. When global oil prices drop, Nigeria’s foreign reserves are affected, reducing the naira’s stability and leading to devaluation.

High Import Demand

Nigeria imports a vast amount of goods, including food, consumer goods, and refined petroleum. High demand for foreign currency to support these imports places pressure on the naira, contributing to devaluation.

Foreign Exchange Reserves and Monetary Policy

Lower foreign exchange reserves limit the Central Bank of Nigeria’s (CBN) ability to support the naira. To manage reserves, the CBN may decide to devalue the naira to reduce pressure on the currency.

Speculation and Black Market

Currency speculation, often driven by instability and lack of confidence in the naira, can lead to higher demand for foreign currencies in the parallel market. This demand often leads to further devaluation of the naira as the CBN adjusts the official rate.

Impacts of Naira Devaluation

Inflationary Pressure

Devaluation typically leads to inflation, as imports become more expensive and businesses pass higher costs to consumers. This has been a significant issue in Nigeria, where double-digit inflation affects household purchasing power.

Decline in Purchasing Power

As the naira loses value, Nigerian citizens experience a reduction in purchasing power, especially for imported goods. This decline impacts living standards, as basic goods and services become costlier.

Pressure on Businesses

Local businesses face higher costs for imported raw materials, equipment, and other inputs, increasing production costs. Small and medium-sized enterprises (SMEs) are particularly affected, as many rely on imports for their operations.

Boost to Exports

Devaluation can make Nigerian goods and services more competitive abroad by lowering their relative cost in foreign markets. However, since Nigeria’s exports are primarily oil-based, the impact on non-oil exports has been limited.

Government Responses to Naira Devaluation

Central Bank Interventions

The CBN has used various tools to support the naira, including adjusting interest rates, managing foreign reserves, and implementing foreign exchange restrictions. However, these measures often provide only short-term relief.

Exchange Rate Management

Nigeria has adopted multiple exchange rate regimes, from fixed to floating, to stabilize the naira. A common approach has been a managed float system, where the CBN controls the official rate while allowing some degree of flexibility.

Foreign Exchange Restrictions

To curb demand for foreign currency, the CBN has imposed restrictions on imports of certain items and limited access to forex for some imports. These measures aim to reduce demand on foreign exchange reserves but can impact availability of imported goods.

Encouraging Local Production

The government has promoted initiatives like the Economic Recovery and Growth Plan (ERGP) and the National Development Plan (NDP) to reduce import dependence by boosting local industries and agriculture. This approach seeks to reduce pressure on the naira in the long term.

Public Debate and Criticism

Economic Effects on Citizens

Many citizens and analysts criticize devaluation for its impact on inflation and cost of living. Devaluation often hits low- and middle-income Nigerians hardest, as essential goods become more expensive.

Pressure from International Institutions

Organizations like the International Monetary Fund (IMF) often recommend currency adjustments to address macroeconomic imbalances, but these suggestions are sometimes controversial in Nigeria, where devaluation can be seen as compromising national sovereignty.

Calls for Policy Reforms

Economists and business leaders have called for comprehensive policy reforms to stabilize the economy. These recommendations include improving the business environment, strengthening infrastructure, and reducing dependence on imports and oil revenue.

Long-term Solutions to Strengthen the Naira

Economic Diversification

Reducing Nigeria’s dependency on oil is seen as critical to achieving long-term stability for the naira. Sectors like agriculture, technology, and manufacturing have significant growth potential and can create alternative revenue sources.

Boosting Non-Oil Exports

Expanding non-oil exports could reduce the demand for foreign exchange. Government programs encouraging export-oriented industries are essential to creating a diversified and stable economy.

Enhancing Foreign Investment

Attracting foreign direct investment (FDI) can help stabilize the naira by boosting foreign reserves and creating jobs. Regulatory reforms to improve transparency and investor confidence are vital for attracting sustained FDI.

Improving Monetary and Fiscal Policies

Effective monetary policy, coupled with prudent fiscal management, can create a stable macroeconomic environment that supports a stronger naira. Policy coherence and stability in exchange rate management are essential for confidence in the naira.

Inflation Rate in Nigeria:

Inflation in Nigeria is a recurring issue, affecting prices, economic stability, and citizens’ purchasing power. Understanding the factors driving inflation, its impacts, and how the government manages it can provide valuable insights into Nigeria’s economic challenges and opportunities.

What is Inflation?

Definition of Inflation

Inflation is the rate at which the general level of prices for goods and services rises, causing purchasing power to decline. When inflation is high, consumers can buy less with the same amount of money, impacting their quality of life.

Types of Inflation

Inflation can be categorized into demand-pull, cost-push, and built-in inflation. Demand-pull occurs when demand exceeds supply; cost-push results from rising production costs; and built-in inflation occurs when prices and wages rise in a cycle.

Measuring Inflation in Nigeria

Consumer Price Index (CPI)

The Consumer Price Index (CPI) is the main tool used to measure inflation in Nigeria. It tracks the price change of a basket of goods and services, such as food, housing, healthcare, and transportation. The National Bureau of Statistics (NBS) publishes monthly CPI reports.

Core Inflation vs. Headline Inflation

Headline inflation includes all items in the CPI, while core inflation excludes volatile items like food and energy. Core inflation provides a clearer picture of long-term price trends, as it is less affected by seasonal factors.

Historical Overview of Inflation in Nigeria

Pre-1980s Period

In the early years post-independence, Nigeria experienced moderate inflation rates, mainly driven by agricultural production and relatively low government spending.

Structural Adjustment Program (SAP) in the 1980s

Inflation surged in the 1980s due to the introduction of the Structural Adjustment Program (SAP), which led to currency devaluation, reduced subsidies, and increased import costs. This program marked the beginning of persistent high inflation rates in Nigeria.

Recent Inflation Trends

Over the past decade, Nigeria has faced double-digit inflation rates, peaking during periods of low oil prices, currency devaluation, and economic recession. Factors like high import dependence, security challenges, and COVID-19 disruptions have also influenced recent trends.

Causes of Inflation in Nigeria

Currency Devaluation

The devaluation of the naira increases the cost of imports, making foreign goods more expensive for Nigerians. Since Nigeria relies heavily on imports, currency devaluation has a significant inflationary impact.

Oil Price Volatility

As an oil-dependent economy, fluctuations in global oil prices can impact government revenue and foreign exchange reserves. When oil prices fall, Nigeria’s revenue drops, often leading to currency depreciation, which fuels inflation.

Import Dependence

Nigeria imports a large portion of its food, machinery, and other essential goods. High import reliance increases exposure to global price changes and exchange rate fluctuations, contributing to inflation.

Insecurity and Disruptions

Security challenges, particularly in the agricultural sector, affect food production and distribution, leading to higher food prices. Additionally, events like the COVID-19 pandemic disrupted supply chains, causing price hikes.

High Production Costs

Poor infrastructure, unreliable power supply, and high transportation costs raise production costs for businesses, which pass these costs onto consumers. High production costs make locally produced goods more expensive, contributing to inflation.

Impact of Inflation on the Nigerian Economy

Reduced Purchasing Power

As inflation rises, the cost of living increases, reducing the purchasing power of Nigerian households. This particularly affects low- and middle-income earners, as they spend a larger portion of their income on essentials like food and housing.

Business Profitability and Investment

High inflation creates uncertainty for businesses, affecting profitability and investment. With unpredictable costs, businesses may delay expansion or reduce production, impacting job creation and economic growth.

Increased Poverty and Inequality

Inflation disproportionately affects lower-income households, exacerbating poverty and inequality. Rising food prices especially impact vulnerable populations, leading to increased food insecurity and malnutrition.

Interest Rates and Borrowing Costs

To control inflation, the Central Bank of Nigeria (CBN) may raise interest rates. Higher interest rates can reduce borrowing by businesses and consumers, potentially slowing economic growth.

Government Responses to Inflation

Monetary Policy

The Central Bank of Nigeria uses monetary policy tools, such as interest rates, to control inflation. By adjusting the Monetary Policy Rate (MPR), the CBN influences borrowing and spending levels in the economy to stabilize prices.

Foreign Exchange Controls

The CBN also manages inflation by controlling foreign exchange rates, using interventions to stabilize the naira. Exchange rate stability helps reduce import costs, which can alleviate inflationary pressures.

Fiscal Policy

The government can influence inflation through fiscal policies, including subsidies and taxation. For example, fuel subsidies help keep energy prices low, although they are often debated for their economic sustainability.

Promotion of Local Production

To reduce import dependency, the Nigerian government has implemented policies to promote local production, particularly in agriculture. Initiatives like the Anchor Borrowers’ Program (ABP) and agricultural incentives aim to boost food production and reduce inflationary pressures.

Challenges in Managing Inflation

Policy Coordination

Effective inflation management requires coordination between monetary and fiscal policy. Lack of coherence between CBN policies and government spending can undermine efforts to control inflation.

Limited Policy Tools

The CBN’s ability to control inflation is often limited by structural issues like infrastructure deficits and insecurity, which cannot be solved through monetary policy alone. Addressing these challenges requires long-term investment and reforms.

Global Economic Pressures

External factors like global oil prices, supply chain disruptions, and foreign exchange inflows are beyond Nigeria’s control, yet they significantly influence inflation. This limits the effectiveness of domestic policies.

Public Resistance to Reforms

Policies to reduce inflation, such as subsidy removal or exchange rate adjustments, often face public resistance. Although these policies can improve economic stability, they may lead to short-term hardship for citizens.

Prospects and Long-term Solutions to Inflation in Nigeria

Economic Diversification

Reducing Nigeria’s reliance on oil and developing other sectors like agriculture, manufacturing, and technology can help stabilize the economy and minimize inflation. Diversification would also reduce dependency on imported goods.

Improving Infrastructure

Addressing infrastructure deficits, such as power supply and transportation, would reduce production costs for businesses, helping control inflation. Improved infrastructure can also boost local production and reduce reliance on imports.

Enhancing Food Security

Investing in the agricultural sector to increase domestic food production is crucial for controlling food prices, which are a major component of inflation. Improved agricultural policies, funding, and security can enhance food security.

Strengthening Foreign Exchange Reserves

Building up foreign exchange reserves can help stabilize the naira, which would reduce import costs and inflationary pressures. This requires prudent management of oil revenues and increased non-oil exports.

Nigeria’s Foreign Exchange Market:

The foreign exchange (forex) market is critical to Nigeria’s economy, shaping trade, investments, and monetary policy. Understanding the structure, challenges, and government policies related to Nigeria’s forex market is essential for comprehending the country’s economic dynamics.

What is a Foreign Exchange Market?

Definition of the Foreign Exchange Market

The foreign exchange market is a global marketplace for buying and selling currencies. In Nigeria, it involves the exchange of the naira (NGN) for foreign currencies, particularly the U.S. dollar (USD), to facilitate international trade and finance.

Importance of the Forex Market

The forex market enables Nigeria to engage in international trade, attract foreign investments, and stabilize the naira. It’s essential for businesses, investors, and individuals who need foreign currencies for imports, education, travel, and investment.

Structure of Nigeria’s Foreign Exchange Market

Official Exchange Market

The Central Bank of Nigeria (CBN) manages the official forex market. This market includes various segments, such as the Investors and Exporters (I&E) Window, the Interbank Market, and other CBN interventions. The I&E window allows foreign investors and exporters to trade at market-determined rates.

Parallel (Black) Market

The parallel or black market operates outside of the official channels, where currency exchange rates are determined by supply and demand without CBN regulation. Many individuals and businesses turn to the parallel market due to limited access to forex in official channels.

Bureau De Change (BDC)

The Bureau De Change segment is regulated by the CBN but operates separately from the official interbank market. BDCs cater to retail forex demands, such as personal travel allowances and small business transactions, although their access to CBN supply has varied over time.

Historical Background of Nigeria’s Forex Market

Fixed Exchange Rate Era

Before the 1980s, Nigeria maintained a fixed exchange rate regime. The government set the naira’s value against major currencies, but this system was unsustainable due to increasing trade imbalances and economic pressures.

Structural Adjustment Program (SAP) and Deregulation

In 1986, Nigeria adopted the Structural Adjustment Program (SAP), which introduced a floating exchange rate and deregulated the forex market. The SAP aimed to align the naira’s value with market forces, marking a significant shift in Nigeria’s exchange rate policy.

Recent Developments

In recent years, Nigeria has faced currency volatility due to oil price fluctuations, low foreign reserves, and economic challenges. The CBN has responded with different exchange rate mechanisms, including the introduction of the I&E window and periodic currency devaluations.

Factors Influencing the Foreign Exchange Market in Nigeria

Oil Price Dependency

Nigeria’s forex inflows are heavily reliant on oil exports, which account for a large percentage of government revenue and foreign reserves. When oil prices fall, forex supply decreases, putting pressure on the naira and leading to currency depreciation.

Demand for Imports

Nigeria imports a significant amount of goods, including food, fuel, and machinery. High demand for foreign currency to pay for imports increases pressure on the forex market, impacting the exchange rate.

Foreign Reserves and Monetary Policy

Nigeria’s foreign reserves, managed by the CBN, play a vital role in stabilizing the forex market. The CBN uses these reserves to intervene in the market, supporting the naira and managing exchange rate fluctuations.

Speculation and Currency Arbitrage

Speculation in the forex market and currency arbitrage between the official and parallel markets create exchange rate volatility. Speculators often buy foreign currency when they anticipate depreciation, increasing demand and exacerbating naira pressure.

Impact of Forex Market on the Nigerian Economy

Inflation and Cost of Living

Exchange rate fluctuations directly affect the cost of imports, contributing to inflation. As the naira depreciates, imported goods become more expensive, raising the cost of living for Nigerian consumers.

Business Operations and Profitability

Businesses that rely on imported raw materials, machinery, and services are impacted by forex volatility. Increased costs for imports affect production costs and profitability, particularly for small and medium-sized enterprises (SMEs).

Foreign Investment and Capital Inflows

The forex market influences investor confidence. When the naira is unstable, foreign investors may be hesitant to invest in Nigeria. Exchange rate stability is key to attracting foreign direct investment (FDI) and capital inflows.

Tourism and Travel

A weak naira affects Nigerians traveling abroad and foreign tourists visiting Nigeria. High exchange rates make foreign travel more costly for Nigerians, while tourists may find Nigeria a more affordable destination, potentially boosting tourism revenue.

Government Policies on the Forex Market

Exchange Rate Management

The CBN has implemented various exchange rate policies, ranging from fixed to managed float systems. These policies aim to stabilize the naira by managing the supply and demand for foreign currency and aligning exchange rates with market conditions.

Forex Restrictions and Import Bans

To reduce demand for foreign currency, the CBN has restricted forex access for importing certain goods, such as rice, textiles, and some processed foods. These measures encourage local production but also impact availability and prices of goods in the market.

Forex Market Interventions

The CBN regularly intervenes in the forex market by selling foreign currency to banks and BDCs to support the naira. These interventions are funded by foreign reserves and are aimed at reducing volatility in the official exchange rate.

Promoting Non-Oil Exports

To reduce dependency on oil, the Nigerian government has introduced policies to encourage non-oil exports, which generate alternative forex inflows. Programs like the Export Expansion Grant (EEG) incentivize exporters and help diversify Nigeria’s forex sources.

Challenges Facing Nigeria’s Forex Market

Oil Dependency and Volatility

Nigeria’s reliance on oil exports makes its forex market vulnerable to oil price fluctuations. Low oil prices can lead to foreign reserve depletion, reduced government revenue, and depreciation of the naira.

Dual Exchange Rates

The existence of both official and parallel exchange rates creates inefficiencies and encourages currency speculation and arbitrage. The gap between these rates leads to distortions, impacting businesses and economic stability.

Limited Forex Supply

Due to high demand and limited supply, Nigeria faces recurring forex shortages. These shortages create pressure on businesses and individuals who need foreign currency, contributing to the rise of the parallel market.

Currency Speculation and Manipulation

Speculators exploit the disparities between the official and parallel markets, further straining the forex market. This manipulation affects exchange rate stability and complicates CBN efforts to manage the market effectively.

Long-term Solutions for a Stable Forex Market in Nigeria

Economic Diversification

Reducing dependency on oil revenue is essential for forex stability. By developing other sectors like agriculture, manufacturing, and technology, Nigeria can create alternative sources of foreign currency and reduce exposure to oil price volatility.

Increasing Foreign Reserves

Building up foreign reserves through prudent management of oil revenue and encouraging non-oil exports can strengthen Nigeria’s ability to support the naira during market fluctuations.

Enhancing Transparency in Exchange Rate Policy

Streamlining exchange rate policies and eliminating the gap between the official and parallel rates would improve transparency and reduce speculation. A unified exchange rate system could build investor confidence and enhance forex market efficiency.

Attracting Foreign Investment

Improving the business environment, enhancing infrastructure, and enforcing policies that protect investments can help attract FDI. Increased FDI would boost forex inflows, strengthen reserves, and reduce pressure on the naira.

Supporting Local Production

Investing in local production, particularly in industries where Nigeria relies heavily on imports, can reduce demand for foreign currency. Policies that support small and medium-sized businesses in agriculture, manufacturing, and technology are essential for achieving this goal.

The Second Naira

The Nigerian naira has gone through significant changes since its introduction. The second naira series, launched in 1973, replaced the first naira and marked Nigeria’s transition from the British pound to a decimal currency system. This guide explores the key aspects, historical development, denominations, and features of the second naira.

Overview of the Second Naira

Introduction of the Second Naira

The second naira was introduced on January 1, 1973, as a major currency overhaul for Nigeria. This marked the adoption of the decimal currency system, where one naira was divided into 100 kobo, moving away from the British system of pounds, shillings, and pence. This change made transactions simpler and aligned Nigeria’s currency system with global standards.

Reasons for Introducing the Second Naira

The adoption of the second naira was part of Nigeria’s post-independence reforms to establish a national identity separate from its colonial past. This move was also driven by the need for an efficient currency system suitable for a growing economy, with simplified calculations and denominations that could serve a wider range of transactions.

Denominations of the Second Naira

Early Denominations

When the second naira was introduced in 1973, the denominations included coins in 1/2 kobo, 1 kobo, 5 kobo, 10 kobo, 25 kobo, and 50 kobo, as well as 1 naira banknotes. These denominations were designed to cover everyday transactions and provide flexibility for both small and larger purchases.

Introduction of Higher Denominations

As Nigeria’s economy grew and inflation began to impact purchasing power, higher denominations were gradually introduced. In the early 1990s, notes of 5 naira, 10 naira, and 20 naira were added, followed by higher denominations such as 50 naira, 100 naira, 200 naira, 500 naira, and, eventually, 1,000 naira.

Current Denominations in Circulation

Today, the denominations of the second naira in circulation include banknotes in 5, 10, 20, 50, 100, 200, 500, and 1,000 naira. Coin denominations now include 50 kobo and 1 naira, though coins are less commonly used due to declining value from inflation.

Design and Features of the Second Naira

Symbolism in Currency Design

The design of the second naira incorporates symbols representing Nigeria’s rich history, culture, and achievements. Prominent Nigerians, such as political leaders and freedom fighters, are featured on various denominations, while images of cultural artifacts, architecture, and agricultural symbols reflect the country’s heritage and economic sectors.

Security Features

To prevent counterfeiting, the second naira includes various security features, particularly in higher denominations. These features have evolved over time to include watermarks, security threads, micro-printing, and special inks. The Central Bank of Nigeria (CBN) periodically updates the currency’s security features to enhance its durability and safeguard against counterfeit production.

Recent Redesign Efforts

In 2022, the CBN initiated a redesign of the 200, 500, and 1,000 naira notes to improve security features and curb currency hoarding. This move aimed to reduce counterfeiting and promote cashless transactions. The new designs also incorporate more modern aesthetics and enhanced durability.

Challenges Facing the Second Naira

Inflation and Purchasing Power

The purchasing power of the naira has been significantly eroded by inflation over the decades. Economic issues such as currency devaluation, high inflation rates, and increasing cost of imports have diminished the value of the naira, affecting the public’s ability to buy goods and services.

Exchange Rate Volatility

The naira faces challenges in maintaining a stable exchange rate due to Nigeria’s dependency on oil exports and foreign currency inflows. This reliance has led to frequent devaluations, with fluctuating oil prices and limited foreign reserves impacting the naira’s stability in the international forex market.

Counterfeiting and Currency Management

The CBN continuously battles counterfeit production and other challenges in currency management. Efforts to introduce advanced security features and encourage cashless transactions have helped reduce the problem but have not fully eradicated counterfeiting issues.

The Role of the Central Bank of Nigeria (CBN)

Currency Issuance and Management

The Central Bank of Nigeria (CBN) is responsible for issuing, managing, and regulating the naira. The CBN oversees currency supply, designs, and policies related to the naira’s circulation, stability, and security features.

Forex Management and Exchange Rate Policy

The CBN manages Nigeria’s foreign exchange market, intervening to support the naira and stabilize exchange rates. By implementing various policies, the CBN aims to balance forex supply and demand and manage the official exchange rate, although exchange rate stability remains challenging.

Cashless Policy and Financial Inclusion

The CBN has promoted a cashless policy to reduce reliance on physical naira notes, aiming to increase electronic transactions and improve financial inclusion. This policy also seeks to reduce currency handling costs, improve security, and support economic digitization.

Importance of the Naira in Nigeria’s Economy

Economic Transactions and Trade

As Nigeria’s official currency, the naira facilitates all economic transactions within the country, from everyday consumer purchases to large corporate and government transactions. It plays a central role in commerce, trade, and investments within Nigeria’s economy.

National Identity and Unity

The naira serves as a symbol of national identity, representing Nigeria’s independence and sovereignty. The currency’s design elements highlight the country’s history and culture, reinforcing national pride and unity among Nigerians.

Influence on the Cost of Living

The naira’s stability and value directly affect Nigerians’ cost of living. When the naira weakens or inflation rises, everyday expenses such as food, housing, and utilities become more expensive, impacting citizens’ quality of life.

The Future of the Naira

Ongoing Reforms and Currency Redesigns

With inflation and currency devaluation continuing to impact the naira, the CBN is expected to continue exploring reforms to stabilize its value. Redesigning currency denominations and promoting a cashless economy are part of the efforts to modernize Nigeria’s currency system.

Potential for Economic Diversification

For the naira to stabilize, Nigeria may need to reduce its reliance on oil exports and diversify its economy. By expanding other sectors like agriculture, manufacturing, and technology, Nigeria can improve foreign exchange inflows and strengthen the naira.

Digital Currency Developments

In 2021, the CBN launched the eNaira, a digital version of the naira, aiming to encourage cashless transactions and improve financial inclusion. The eNaira provides an alternative to physical currency, potentially reducing the cost of currency production and circulation while promoting economic digitization.

The 2022 Redesign

The Nigerian Naira (NGN) is the official currency of Nigeria, issued and regulated by the Central Bank of Nigeria (CBN). In 2022, the CBN introduced redesigned versions of some of the currency’s denominations in a bid to improve security, combat counterfeiting, and promote digital transactions. This guide covers the details of this 2022 redesign, including its motivations, new features, and effects on Nigeria’s financial landscape.

Background of the 2022 Redesign

Purpose of the Redesign

The Central Bank of Nigeria introduced the 2022 redesign to tackle several pressing issues affecting the Nigerian currency system. These included the need to reduce counterfeiting, encourage a cashless economy, address currency hoarding, and improve the overall integrity of the naira. The redesign aimed to boost national security and maintain public confidence in Nigeria’s currency.

Denominations Affected

The redesign in 2022 affected three key denominations of the naira:

- N200

- N500

- N1000

These are the highest-value notes in circulation, and they account for a large portion of transactions in Nigeria. The redesign did not include lower denominations, as the CBN focused on reducing the circulation of high-value notes to limit currency hoarding and encourage digital payments.

Features of the New Naira Notes

Enhanced Security Features

The redesigned notes feature advanced security elements to combat counterfeiting. These include:

Improved Watermarks: Making it harder to reproduce the notes.

Security Threads: With more distinct, color-shifting threads for enhanced visibility.

Micro-lettering and Holographic Patterns: Adding to the difficulty of duplicating the notes.

Color Shifting Ink: Visible from various angles to help authenticate the currency.

Design and Color Changes

The most noticeable change in the 2022 naira redesign is the color scheme of each denomination:

N200 Note: The N200 note saw a transition to a more pronounced blue color.

N500 Note: The N500 note adopted a more vibrant green.

N1000 Note: The highest denomination, N1000, now has a bolder, deeper red hue.

These color adjustments aimed to make each note more distinguishable at a glance while providing an update to the currency’s overall appearance.

Material and Durability

The redesigned naira notes were printed on a more durable material, enabling them to withstand Nigeria’s humid climate and high circulation rates. This durability helps reduce the frequency of currency reprints and promotes cleaner, longer-lasting notes in circulation.

Implementation and Transition

Phased Introduction

The CBN launched a phased approach to the introduction of the redesigned naira notes. This phased rollout helped Nigerians familiarize themselves with the new design while allowing banks and ATMs to stock the new currency.

Public Awareness Campaigns

To help Nigerians transition smoothly to the new notes, the CBN conducted public awareness campaigns. These campaigns aimed to educate citizens on identifying the new notes, using them safely, and recognizing counterfeit prevention features.

Implications of the Redesign

Economic Impact

The redesign was part of a broader effort to encourage the adoption of digital transactions and reduce reliance on physical cash. By limiting the amount of high-value cash in circulation, the CBN hoped to combat issues such as currency hoarding, inflation, and illicit financial activities.

Reception and Public Response

Reactions to the 2022 redesign were mixed. While many Nigerians supported the anti-counterfeiting and economic goals behind the new design, others were concerned about the cost and inconvenience associated with the currency transition. Financial institutions and markets also had to adjust to the logistical demands of the redesign.

Nigerian Naira: Hidden Naira Notes

The Nigerian Naira, Nigeria’s official currency, is issued and managed by the Central Bank of Nigeria (CBN). While the visible, widely circulated notes are well-known, there is also an intriguing aspect referred to as “Hidden Naira Notes.” This term usually pertains to the uncirculated notes that remain in banks or other secured storage facilities and are not in active circulation. Hidden naira notes play a role in Nigeria’s monetary policy, currency supply control, and the economy at large.

What are Hidden Naira Notes?

Definition of Hidden Naira Notes

Hidden Naira Notes refer to currency that has been printed by the CBN but is either held in reserve or deliberately withheld from public circulation. These notes are stored within the CBN, commercial banks, or other secure locations and are not accessible to the general public.

Purpose of Hidden Naira Notes

Hidden Naira Notes serve multiple functions within Nigeria’s financial system:

Monetary Supply Management: The CBN uses these notes to manage the supply of cash in circulation, releasing them as needed to control inflation or respond to currency demands.

Emergency Reserves: Hidden notes act as a buffer to meet sudden spikes in demand, such as during holiday seasons, economic crises, or national emergencies.

Counterfeit Control: By keeping a reserve of newer, more secure notes, the CBN can combat counterfeiting by replacing older notes with more secure ones when necessary.

Why Does the Central Bank of Nigeria Hold Hidden Naira Notes?

Inflation Control

One key reason for holding hidden notes is to help control inflation. By regulating how much cash is in public circulation, the CBN can influence inflation levels. If too many naira notes are in circulation, the value of the naira might decrease, leading to inflation. By maintaining hidden reserves, the CBN has the option to control the money supply more precisely.

Supporting Currency Stability

Hidden notes are also a tool for stabilizing the naira against foreign currencies. When the naira’s value drops, the CBN can strategically release or withdraw hidden notes to help balance the economy and stabilize currency exchange rates.

Gradual Currency Transition

During redesigns or changes to currency features, the CBN may keep the new notes hidden until they are ready to replace the old ones. This gradual transition helps prevent abrupt shocks to the economy and allows banks to phase in new notes smoothly.

Controversies and Public Perceptions

Concerns Over Currency Hoarding

Some Nigerians believe hidden notes contribute to currency hoarding, as there is a perception that high-denomination notes are withheld by certain groups or used for political or economic manipulation. This perception has fueled public debate and criticism of the CBN’s currency policies.

Public Calls for Transparency

Many citizens and financial analysts advocate for greater transparency regarding the volume and distribution of hidden notes. Increased transparency could help the public understand the rationale behind holding these notes and potentially reduce skepticism around the CBN’s management of the Nigerian naira.

Economic Implications of Hidden Naira Notes

Limited Cash Circulation

Hidden notes can reduce the volume of cash available for everyday transactions, particularly in rural areas where digital banking options may be less accessible. This can lead to cash scarcity, affecting businesses and local economies.

Impact on the Informal Sector

Nigeria’s informal economy relies heavily on cash transactions. When large amounts of currency are kept hidden, it may affect cash flow within this sector, making it harder for people to carry out daily transactions and potentially pushing them toward alternative currencies.

Influence on Digital Banking

As the CBN holds back some cash from circulation, it indirectly encourages digital banking and online transactions. By reducing physical cash, hidden notes may push people toward mobile money solutions, internet banking, and other digital finance platforms, advancing Nigeria’s cashless policy goals.

Nigerian Naira: Exchange Rates

The Nigerian Naira (NGN) is the official currency of Nigeria, managed by the Central Bank of Nigeria (CBN). Like most national currencies, the naira’s value fluctuates against other global currencies, particularly major ones like the US dollar (USD), British pound (GBP), and Euro (EUR). These exchange rates are influenced by several economic factors and policies. This guide explores how Nigerian naira exchange rates work, factors affecting them, and the types of rates commonly used in Nigeria.

Types of Naira Exchange Rates

Official Exchange Rate

The official exchange rate is the rate set by the CBN and used for government and certain official transactions. It is typically lower than the rate available on the open market, as the CBN manages this rate to maintain a level of economic stability. The official rate is used for trade with other countries and for specific sectors, such as education and healthcare, to ensure Nigerians can afford essential goods and services.

Parallel Market (Black Market) Rate

The parallel market rate, also known as the black market rate, is the rate at which foreign currencies are exchanged for naira outside official channels. This rate is determined by supply and demand in the informal sector and is generally higher than the official rate. Factors such as limited foreign currency access through official channels, economic conditions, and demand for foreign exchange affect the parallel market rate. Many Nigerians and businesses resort to this market when they cannot access foreign currency at the official rate.

NAFEX (Investors and Exporters) Rate

The Nigerian Autonomous Foreign Exchange Rate Fixing (NAFEX) rate, also called the “I&E” rate, is an exchange rate system introduced in 2017 for foreign investors, exporters, and importers. This rate is determined by market dynamics but regulated by the CBN to ensure stability. The NAFEX rate is closer to the real market value of the Nigerian naira, and it plays a significant role in attracting foreign investment and promoting transparency in foreign exchange transactions.

Factors Affecting Nigerian Naira Exchange Rates

Oil Prices

Nigeria is a major exporter of oil, and oil revenues significantly impact the country’s foreign exchange reserves. When oil prices rise, Nigeria’s foreign reserves increase, which often strengthens the Nigerian naira. Conversely, a drop in oil prices can weaken the naira, as it limits Nigeria’s foreign exchange earnings and puts pressure on the currency’s value.

Inflation Rates

High inflation rates in Nigeria tend to reduce the purchasing power of the naira, leading to depreciation. When inflation is high, the CBN may intervene in the currency market by adjusting interest rates or other monetary policies, but this often puts pressure on the naira and affects exchange rates.

Foreign Exchange Reserves

Foreign exchange reserves are assets held by the CBN in foreign currencies. These reserves act as a buffer to stabilize the naira during economic volatility. If reserves are high, the CBN can use them to defend the naira, thereby keeping the official rate more stable. Low reserves, however, limit this ability, often leading to a weaker naira.

Interest Rates

Higher interest rates attract foreign investments, as investors seek returns on their investments. When the CBN raises interest rates, it can increase demand for the Nigerian naira, thereby strengthening its value. Conversely, lower interest rates may reduce foreign investment, weakening the naira.

Political Stability

Political stability plays a significant role in exchange rate stability. Political instability or uncertainty can lead to a lack of confidence in the economy, leading investors to withdraw capital and exchange naira for more stable currencies. This capital flight can depreciate the Nigerian naira.

Impact of Exchange Rates on the Nigerian Economy

Import and Export Balance

Fluctuating exchange rates impact Nigeria’s trade balance. A weaker Nigerian naira makes imports more expensive, which affects businesses that rely on imported goods and materials. However, a weaker naira can also boost exports, as Nigerian goods become cheaper for foreign buyers.

Inflation and Cost of Living

Exchange rates directly affect inflation and the cost of living. When the naira depreciates, imported goods become more expensive, leading to increased prices for food, fuel, and essential items. This, in turn, can drive inflation, impacting the overall economy and standard of living.

Impact on Foreign Investment

Stable exchange rates are crucial for attracting foreign investment. When the naira is volatile, investors are wary of currency risks, which can deter investment in Nigerian industries. However, a stable or slightly depreciated naira can attract foreign capital, especially if investors believe it will strengthen in the future.

In conclusion, the Nigerian Naira (NGN) plays a crucial role in the country’s economy, reflecting the dynamics of both local and global markets. Understanding its fluctuations and the factors influencing its value is essential for investors and businesses operating in Nigeria. For more in-depth insights, you can explore resources from the Central Bank of Nigeria, Investopedia, and XE Currency Converter. Staying informed about the Naira’s performance can help you make better financial decisions in this vibrant economy.

Naira Savings Accounts:

A Naira savings account is a fundamental banking service in Nigeria, providing individuals and businesses with a secure way to save money in the local currency. Savings accounts offer convenient access to funds, interest accrual on deposits, and various banking benefits. This guide outlines the types, features, requirements, and benefits of Naira savings accounts to help you understand how they work and choose the best option for your financial needs.

What is a Naira Savings Account?

A Naira savings account is a bank account denominated in Nigerian Naira (NGN) that allows individuals to deposit and save money while earning interest on the balance. These accounts are offered by commercial banks, microfinance banks, and digital banks in Nigeria. They are typically designed for personal savings but can also be used for business purposes in some cases.

Types of Naira Savings Accounts

Basic Savings Accounts

Basic savings accounts are the most common type of savings accounts offered by Nigerian banks. They typically require a low minimum deposit to open and allow for convenient deposits and withdrawals. These accounts are ideal for everyday savings, and they usually come with a debit card for easy access to funds through ATMs and point-of-sale (POS) machines.

High-Interest Savings Accounts

High-interest savings accounts offer a higher interest rate compared to standard savings accounts. These accounts are designed to encourage people to save more by rewarding them with better returns on their balance. However, they may have higher minimum balance requirements and may limit the frequency of withdrawals to maintain the interest rate.

Fixed Savings Accounts

Fixed savings accounts, also known as “fixed deposits,” allow individuals to save a lump sum for a specified period, such as 3, 6, or 12 months, at a fixed interest rate. These accounts do not permit withdrawals until the end of the agreed period. They are ideal for people who want to earn a higher return on their savings without the temptation to withdraw funds prematurely.

Target or Goal-Oriented Savings Accounts

Target or goal-oriented savings accounts allow individuals to save towards a specific goal, such as buying a car, funding education, or building an emergency fund. These accounts often come with fixed tenures and may offer higher interest rates. They may also restrict withdrawals to ensure savers reach their goals.

Digital-Only Savings Accounts

Digital banks and mobile financial service providers offer digital-only savings accounts that can be opened and managed entirely online or through mobile apps. These accounts usually have lower fees, provide convenient access, and offer competitive interest rates. They are ideal for tech-savvy individuals looking for a flexible savings solution.

Key Features of Naira Savings Accounts

Interest on Savings

Most Naira savings accounts offer interest on deposited funds. The interest rate may vary based on the type of account, the bank’s policy, and the balance maintained in the account. Interest is usually paid monthly or quarterly and can vary depending on prevailing economic conditions and CBN regulations.

Accessibility and Flexibility

Naira savings accounts are designed for flexibility, with options for deposits and withdrawals. Account holders can access their funds through ATMs, bank branches, mobile banking, internet banking, and point-of-sale (POS) terminals, depending on the bank’s service options.

Minimum Balance Requirements

Many savings accounts in Nigeria require a minimum balance to be maintained. This minimum varies across banks and account types, with some accounts having no minimum requirement and others requiring a higher balance to earn interest.

Fees and Charges

Some savings accounts may have maintenance fees, withdrawal charges, or transfer fees. These fees vary across banks, and digital banks often offer savings accounts with minimal or no fees. It’s important to review the terms and conditions of each account type to understand any associated costs.

Opening a Naira Savings Account: Requirements

Basic Documentation

To open a Naira savings account, prospective account holders typically need to provide the following documentation:

Valid Identification: This could include a National Identity Card, Voter’s Card, Driver’s License, or International Passport.

Proof of Address: Utility bills, tenancy agreements, or bank statements showing the applicant’s address.

Passport Photographs: Banks typically require recent passport-sized photos.

Bank Verification Number (BVN): A unique identification number issued by the CBN to track banking activities in Nigeria.

Minimum Initial Deposit

Some banks require an initial deposit to open a savings account, though this amount varies based on the bank and type of savings account. Many digital banks offer savings accounts with little or no initial deposit requirement.

Digital Account Opening

Many banks now allow account opening through mobile apps or websites. This digital process reduces the need for physical bank visits and makes it easy for users to open accounts quickly and conveniently.

Benefits of Naira Savings Accounts

Security of Funds

Banks are regulated by the CBN, ensuring a high level of financial security for account holders. Deposits in most commercial banks are also insured by the Nigeria Deposit Insurance Corporation (NDIC), which protects savings up to a certain limit in case of bank failure.

Interest Earnings

Naira savings accounts allow account holders to earn interest on their deposits, which helps to grow savings over time. Though the interest rates are generally modest, they provide additional income, particularly for high-interest or fixed savings accounts.

Budgeting and Financial Discipline

Having a dedicated savings account helps account holders manage their finances better, encouraging regular savings habits. Targeted or goal-oriented accounts can help individuals save toward specific financial goals and promote disciplined saving practices.

Convenient Access to Banking Services

Savings accounts come with access to essential banking services such as ATM withdrawals, mobile banking, internet banking, and POS payments. Many banks also offer debit cards, allowing account holders to make purchases and payments easily.

Eligibility for Loans and Financial Services

Having a savings account with consistent deposits can help account holders build a relationship with their bank, which may make them eligible for future loans or credit products.

Choosing the Right Naira Savings Account

When selecting a Naira savings account, consider the following factors:

Interest Rate: Compare interest rates across banks to find an account that offers the best return.

Accessibility: Consider how easy it will be to access funds when needed, especially if you prefer digital-only options.

Minimum Balance Requirements: Ensure the account meets your saving capacity and can be maintained without incurring fees.

Account Fees: Look out for accounts with minimal fees to maximize your savings.

Additional Benefits: Some accounts may offer extra benefits, like cash bonuses, rewards, or discounts for maintaining a certain balance.

Naira Investment Options: A Guide to Growing Wealth in Nigeria

Investing in Naira-based assets can be an effective way to grow wealth and secure financial stability in Nigeria. The Central Bank of Nigeria (CBN) and various financial institutions offer numerous investment options in Naira, catering to different risk tolerances, timeframes, and financial goals. This guide explores popular Naira investment options, including their benefits, risks, and suitability for different investor profiles.

Why Invest in Naira-Based Assets?

Inflation Protection

With inflation impacting the purchasing power of the Naira, investing in assets that offer returns above the inflation rate is essential to preserve and grow wealth.

Wealth Building

Naira-based investments provide a way to build wealth over time through compounding returns, interest earnings, or asset appreciation.

Accessibility

Many Naira investment options are available to local investors, with relatively low minimum investment requirements, making them accessible to a broader range of Nigerians.

Popular Naira Investment Options

- Fixed Deposits

Fixed deposit accounts are savings accounts where a lump sum is invested at a fixed interest rate for a predetermined period, typically ranging from 30 days to a few years. They offer higher interest rates than regular savings accounts.

Pros: Guaranteed returns, low risk, and a straightforward investment process.

Cons: Limited liquidity, as funds are locked for a fixed term.

Best For: Conservative investors seeking a safe place to park money for a short or medium term.

- Treasury Bills

Treasury bills (T-bills) are short-term government securities issued by the CBN to finance government expenses. T-bills mature in periods of 91, 182, or 364 days and are considered one of the safest Naira investments.

Pros: Low risk, government-backed, highly liquid, and offers interest above savings accounts.

Cons: Returns are lower than those of riskier investments, and they may not beat inflation in high-inflation periods.

Best For: Investors looking for a secure and liquid short-term investment.

- Government Bonds

Nigerian government bonds are longer-term debt securities issued by the government, with terms ranging from 2 to 30 years. Bondholders earn semiannual interest payments until maturity, at which point the principal is repaid.

Pros: Stable returns, government-backed, provides a regular income stream, and inflation-protected bonds are available.

Cons: Longer lock-in period and some interest rate risks if sold before maturity.

Best For: Moderate to conservative investors seeking stable, long-term returns and regular income.

- Mutual Funds

Mutual funds pool money from multiple investors to invest in a diversified portfolio of assets like stocks, bonds, and money market instruments. Nigerian mutual funds are typically offered by asset management firms and come in various types, such as equity funds, bond funds, and money market funds.

Pros: Diversified investment, professionally managed, and relatively low minimum investment.

Cons: Management fees, and returns vary depending on the fund’s performance.

Best For: Beginners or those with limited funds who want exposure to various assets without direct management.

- Stocks and Equities

Investing in Nigerian companies’ stocks listed on the Nigerian Exchange (NGX) offers the potential for high returns through dividends and capital appreciation. Stocks represent partial ownership in a company, so shareholders benefit when the company performs well.

Pros: Potential for high returns, dividend income, and access to top-performing companies.

Cons: High volatility and risk of capital loss, especially in periods of economic downturn.

Best For: Aggressive investors with a long-term horizon and tolerance for market fluctuations.

- Real Estate Investment

Real estate remains one of the most popular investment options in Nigeria due to its potential for long-term capital appreciation and rental income. Investment options range from residential and commercial properties to land.

Pros: Potential for rental income, property appreciation, and inflation protection.

Cons: Requires significant capital, involves property management costs, and can be illiquid.

Best For: Investors with substantial capital seeking tangible assets with long-term growth.

- Real Estate Investment Trusts (REITs)

Real Estate Investment Trusts (REITs) allow investors to invest in a portfolio of income-generating real estate assets, without directly owning property. REITs are traded on the Nigerian Exchange and offer an alternative way to benefit from real estate without needing large capital.

Pros: Provides exposure to real estate, requires a lower investment amount than direct real estate, and offers liquidity.

Cons: Returns depend on real estate market performance, and there may be management fees.

Best For: Investors who want exposure to real estate with more liquidity and lower capital requirements.

- Corporate Bonds

Corporate bonds are debt securities issued by private or public Nigerian companies to raise capital. Investors earn fixed interest payments until the bond matures.

Pros: Higher returns than government bonds, provides a fixed income stream, and can be traded on secondary markets.

Cons: Higher risk compared to government bonds, as repayment depends on the issuing company’s financial health.

Best For: Income-focused investors with moderate risk tolerance.

- Agriculture Investment Platforms

Agriculture investment platforms allow individuals to invest in Nigerian agriculture projects, such as crop production, poultry farming, and fish farming, by sponsoring specific projects in exchange for returns.

Pros: High return potential, supports local agriculture, and provides diversification.

Cons: High risk due to the unpredictable nature of agriculture and weather dependency.

Best For: High-risk-tolerant investors interested in socially impactful investments.

- Foreign Exchange (Forex) Trading

Forex trading involves buying and selling foreign currencies, profiting from fluctuations in exchange rates. Although risky and speculative, it can offer high returns for knowledgeable investors.

Pros: High return potential, liquidity, and flexible trading hours.

Cons: High risk, requires in-depth knowledge, and is susceptible to market volatility.

Best For: Experienced investors with a high risk tolerance and knowledge of currency markets.

Key Factors to Consider When Choosing a Naira Investment Option

Risk Tolerance

Consider your ability to handle potential losses and price fluctuations. High-risk options like stocks and forex trading offer higher returns but come with more volatility, while safer investments like T-bills and government bonds offer stable returns with minimal risk.

Investment Horizon

The duration for which you plan to invest plays a crucial role in choosing an option. For instance, stocks and real estate are better suited to long-term investments, while T-bills and money market funds are more appropriate for short-term goals.

Returns on Investment

Analyze potential returns, considering inflation and opportunity costs. Ensure the expected returns align with your financial goals and are enough to compensate for the risks involved.